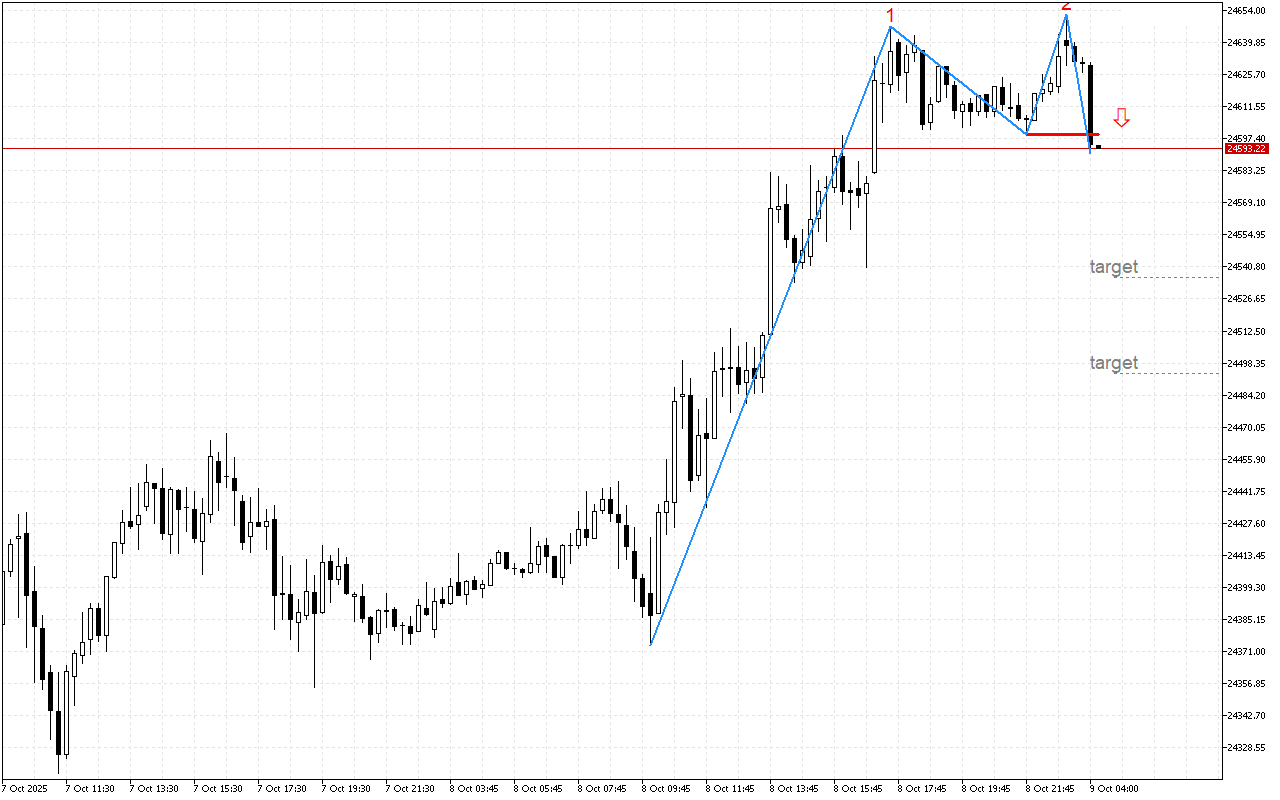

The DAX 40 pattern revealed on the chart indicates weakness in upward momentum.

A classic Double Top reversal pattern is being formed on the chart. The breakdown of the neckline at the level of 24599.39 serves as the main signal for confirmation. Next we can consider two possible scenarios for the development of events. The first scenario assumes the price fixing below the neckline and a further price decline. In the second scenario, the price may return behind the neckline, which may lead to the pattern being canceled and the upward movement continuing.

In this situation, it is worth considering short positions to trade DAX 40.

📌 Entry: 24594.22

✔️ First target: 24535.99

✔️ Second target: 24493.73

❌ Stop order: 24652.22